The Future of AI in Singapore's Trading Landscape

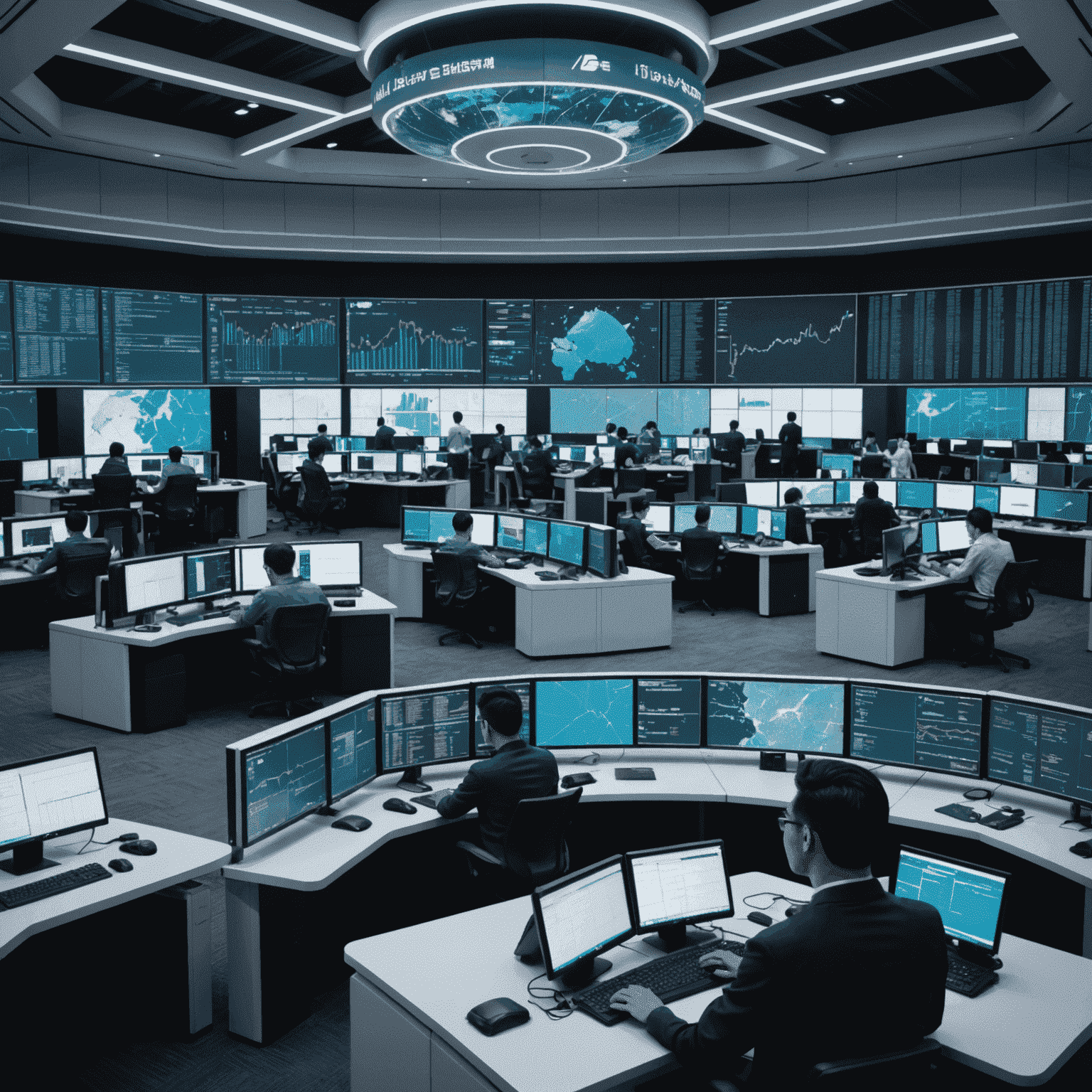

As a global financial hub, Singapore is at the forefront of integrating artificial intelligence into its trading ecosystem. This technological revolution is set to reshape the city-state's role in driving AI innovation in finance.

AI's Impact on Singapore's Trading Infrastructure

Singapore's trading landscape is on the cusp of a major transformation, with AI technologies poised to revolutionize every aspect of the financial markets. From high-frequency trading algorithms to predictive analytics for risk management, AI is becoming an indispensable tool for traders and financial institutions in the Lion City.

Key Areas of AI Integration:

- Algorithmic Trading: AI-powered systems are executing trades at unprecedented speeds, analyzing market data in real-time.

- Risk Assessment: Machine learning models are enhancing the accuracy of risk predictions, allowing for more informed decision-making.

- Fraud Detection: AI algorithms are bolstering security measures by identifying unusual patterns and potential fraudulent activities.

- Customer Service: Chatbots and virtual assistants are providing 24/7 support to traders and investors.

Singapore's Role in Driving AI Innovation

The Singaporean government and private sector are working hand in hand to position the city-state as a global leader in AI-driven financial technologies. Initiatives such as the National Artificial Intelligence Strategy and the establishment of AI research centers are fostering an environment ripe for innovation.

Singapore's Competitive Advantages:

- Robust Regulatory Framework: The Monetary Authority of Singapore (MAS) is developing AI governance frameworks to ensure responsible AI adoption in finance.

- Talent Pool: Singapore's world-class universities and global talent attraction policies are creating a deep pool of AI and finance experts.

- Infrastructure: The city-state's advanced digital infrastructure and data centers provide the backbone for AI-powered trading systems.

- Strategic Location: As a bridge between East and West, Singapore is ideally positioned to become an AI hub for global trading.

Challenges and Opportunities

While the potential of AI in trading is immense, it also presents challenges that Singapore must navigate:

- Ethical Considerations: Ensuring AI systems make fair and unbiased trading decisions.

- Job Displacement: Addressing potential job losses in traditional trading roles through reskilling initiatives.

- Cybersecurity: Strengthening defenses against increasingly sophisticated cyber threats targeting AI systems.

However, these challenges also present opportunities for Singapore to lead in developing solutions and best practices for AI in finance globally.

The Road Ahead

As AI continues to evolve, Singapore's trading landscape is set to become more efficient, transparent, and innovative. The city-state's commitment to embracing AI while maintaining a strong regulatory environment positions it to become a model for other financial centers around the world.

For companies like iTiger, which are at the intersection of technology and finance, Singapore's AI-driven future in trading offers exciting possibilities. As the lines between traditional finance and cutting-edge technology continue to blur, Singapore is poised to remain at the forefront of this revolutionary change in global trading.

As we look to the future, it's clear that AI will play a pivotal role in shaping Singapore's trading ecosystem. The city-state's proactive approach to AI adoption and regulation ensures that it will continue to be a key player in the global financial markets, driving innovation and setting standards for the integration of AI in trading worldwide.